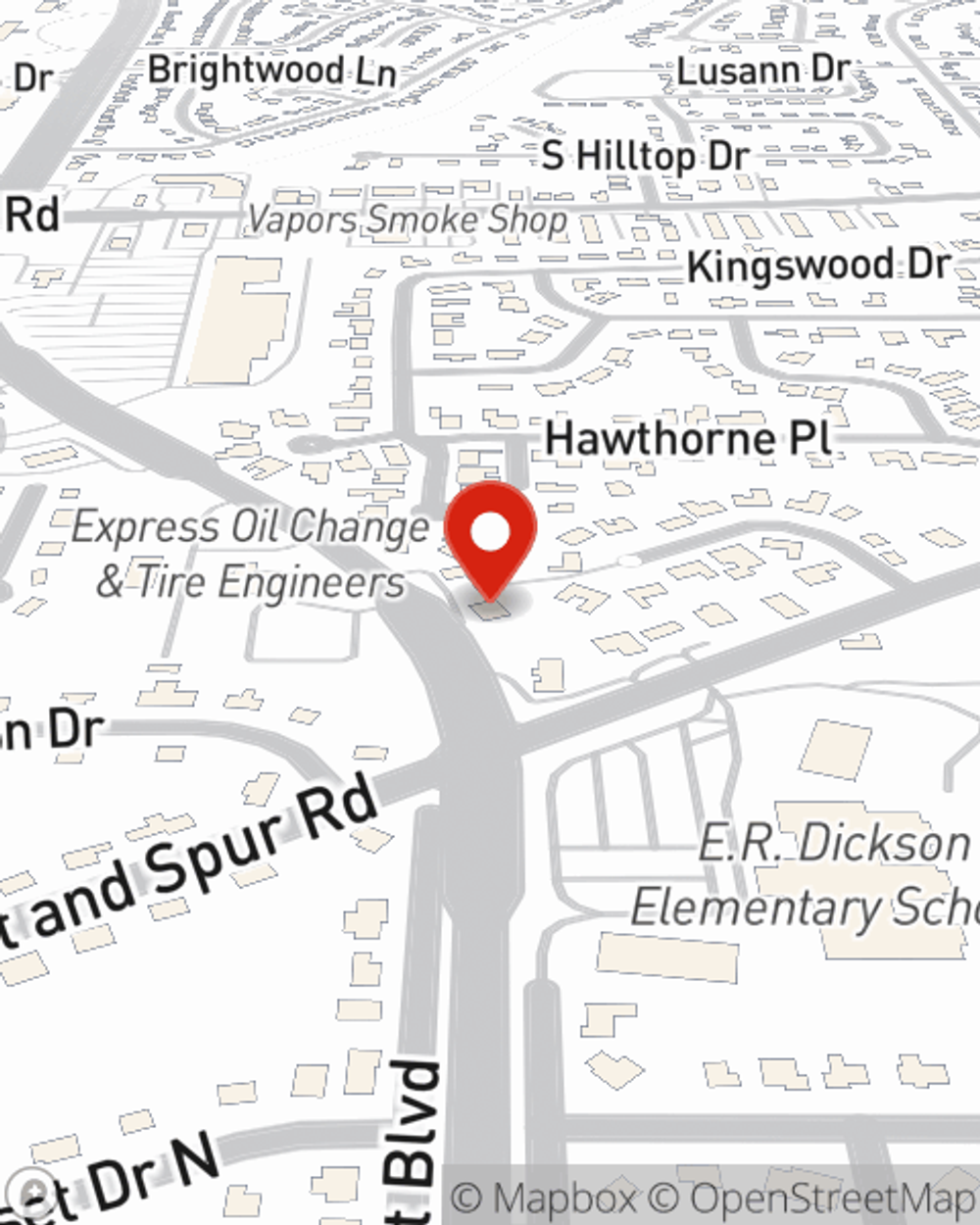

Business Insurance in and around Mobile

Get your Mobile business covered, right here!

This small business insurance is not risky

- Mobile, AL

- Mobile County

- Baldwin County

- Lucedale, MS

- Pensacola, FL

- Atlanta, GA

- Fairhope, AL

- Saraland, AL

- George County

- Escambia County

- West Mobile

- Daphne, AL

- Coweta County

- Savannah, GA

State Farm Understands Small Businesses.

When you're a business owner, there's so much to keep track of. We get it. State Farm agent Rebekah Brown is a business owner, too. Let Rebekah Brown help you make sure that your business is properly protected. You won't regret it!

Get your Mobile business covered, right here!

This small business insurance is not risky

Keep Your Business Secure

Whether you are a psychologist a locksmith, or you own an antique store, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Rebekah Brown can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and loss of income and extra expense.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Visit State Farm agent Rebekah Brown's team today with any questions you may have.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Rebekah Brown

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.